Over the past few months, the Callisto Network Ecosystem has made significant steps toward mass adoption and has encompassed partnerships with Artefin Art Gallery, Esport Innovation Group, GAT Network and BitKeep but also sponsorships with Rally21; or even an Art Contest as part of the Prague Art Week!

And this is only the start, as, through the “We Fund You” initiative, we support the most promising projects and teams that want to build innovative applications on top of the Callisto Network. The Callisto Network ecosystem also expands its frontiers from a technical perspective with the cross-chain bridge, which offers a highly secured, low-cost way to transfer value between different blockchains.

Of course, that is not all, but as suggested by the title of this article, we shall review what the Callisto Network team is working on and what you can expect for late 2022 and early 2023.

The Moon Day 2022 strategy consists of 7 major milestones, each described below. Let’s get started!

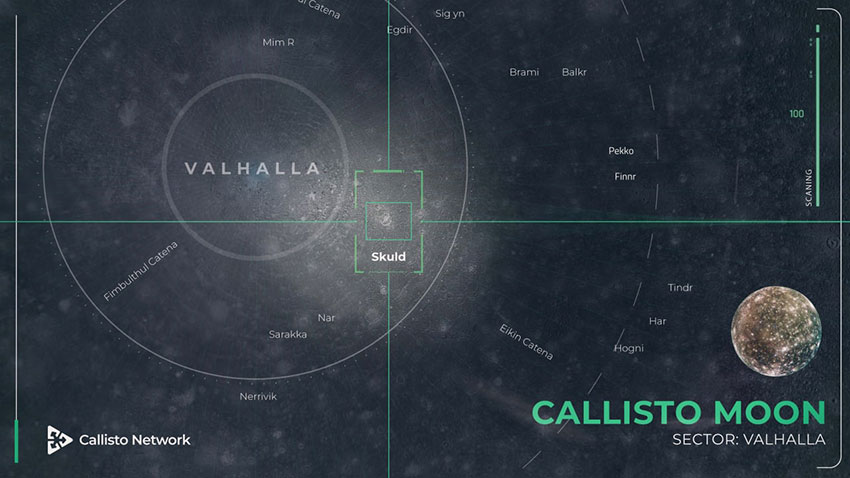

Skuld Hard Fork - Dynamic Monetary Policy

Implementation: Q4-2022

“In Norse mythology, three goddesses weave the threads of destiny, Urd symbolizes the past, Verdande the present, and Skuld, the youngest goddess, represents the future.”

In the upcoming months, Callisto Network will implement the Dynamic Monetary Policy, introducing for the first time a dynamic rate of inflation/deflation based on blockchain usage to ensure the security and stability of the network.

With the number of burned coins depending on the network utilization, the dynamic monetary policy starts to be deflationary from a medium block utilization. Thus in the long term, CLO can be considered as a store of value asset similar to Bitcoin.

As changes will be applied to the PoW mechanism towards a greener and more scalable layer 1 solution, the deflation rate is expected to further increase in the short term.

Another advantage of the proposed Monetary Policy is that it ensures the highest security thanks to a fixed emission of coins, thus offering incentives to miners to secure the network continuously.

It is known that inflation reduces a currency’s value over time while deflation increases it. This is why the Callisto Network Dynamic Monetary Policy will alternate inflation and deflation phases:

- Inflation phase: The network utilization is low, no coins are burned, and miners compete to get the fixed block reward.

- Deflation phase: In the phases with high network usage, the total supply of coins is reduced via a transaction fee-burning mechanism, increasing the value of the coins in circulation while the miners’ reward remains unchanged.

To provide the network with optimal stability, the max coin supply will be reduced from 6,500,000,000 CLO to 3,000,000,000 CLO and maintained at this level. As the current circulating supply is 3,192,368,133 CLO, an estimated 200 million CLO coins will be burned (6% of the current circulating supply).

Short-Term Impacts

- ~190 million CLO coins to be burned. Inflation stopped.

- A greener PoW model thanks to the combination of the Dynamic Monetary Policy, Pirlguard, and ZPoW.

Mid/Long-Term Impacts

- Limited supply, inflation controlled.

- Sustainable PoW model with incentives for miners.

- Cold Staking APR greater than 12% on average*

* Under the assumption that 40% of the coins in circulation are deposited in the Cold Staking smart contract. The actual number depends on the number of the CLO coins locked coins.

Security Department V2

Implementation: Q4-2022

Callisto Enterprise team combines an unparalleled experience and reputation in cybersecurity.

Nevertheless, it is a reality that Callisto Network’s security department has lacked visibility in the past years, and we have not been able to capitalize on the work accomplished. The reasons are several; a small team, a significant growth of the Callisto Network ecosystem that monopolized most of the resources, and the lack of communication.

To remedy this situation, we will take the following actions over the next few months, laying the groundwork for a fully decentralized auditing protocol that will operate on top of the Callisto Network:

Improvements

- Expand the security department with new auditors.

- Provide a broader range of services & additional means for requesting an audit.

Innovations

- Design and develop a distributed auditing process on top of Callisto Network (protocol level).

- Design of a continuous audit service financed by Bug Bounties funds and distributed insurance.

- Operation of the first distributed insurance fund to enhance the security of the smart contracts.

- Additional Security department funding through Immortal Lottery pools.

Communication

- Development of a web portal dedicated to security audits with a simplified display and a search function.

- Regular marketing campaigns on platforms intended for developers (“Etherscan”, “BSCscan”, etc.).

Callisto Network Migration Service

Implementation: Q4-2022

Given the undeniable advantages of the Callisto Network and the benefits of the implementations described in this document, we intend to encourage developers to join the Callisto Network ecosystem. Indeed, the technological maturity of a blockchain, its security, the number of transactions per second, and the cost per transaction may justify a developer’s decision to migrate from one platform to the other.

Callisto Network is a public proof-of-work blockchain protocol based on the Ethereum Virtual Machine (EVM). This makes it fully compatible with Ethereum and any EVM-based chain, such as Binance Smart Chain, Polygon, and Avalanche. In other words, any smart contracts and DAPPs developed for these chains can be easily migrated to Callisto Network – without code changes – to benefit from significantly lower transaction fees and higher security standards.

The migration service will consist of assisting developers in the migration of Solidity contracts to Callisto Network. As part of this process, Callisto Network’s security experts will read, understand, audit, and improve every line of code to ensure that the existing smart contract is secure while preserving all original functionalities.

For enhanced security, tokens and NFTs will be upgraded to ERC-223 / CallistoNFT standards during the migration.

The service includes the delivery of the following:

- The final source code (public or private).

- The audit report.

- The deployment of the smart contract.

- Documentation of the new smart contract.

- Guidance and technical support after deployment.

Cross-Chain Bridge & Masternodes

Implementation: Q4-2022

The DeFi ecosystem has attracted the interest of users and investors over the last few years. Through them, the exchange of value in means of tokens was enabled, and deep liquidity was attracted. However, till today this value remains isolated and in-accessible to different networks due to the lack of a user-friendly service that can offer:

- Increased security

- Exchange rate close to the real one even for large orders.

By introducing Callisto Bridge and then Soy Bridge, Callisto Network provided significant improvement to the standard bridge model:

Callisto Bridge Security Improvements

- Introduced for the first time a layered security model.

- Semi-centralized “authorities” relays.

Soy Bridge UI & UX Improvements

- Optimized graphic interface.

- Allow for buying the destination blockchain native coin and start trading immediately.

- Automated claim for first-time users; If a user doesn’t have a destination blockchain native coin to claim his transaction, the bridge will claim it for free.

The cross-chain bridge currently supports coins/tokens transfer between several blockchains, with NFT transfer being the next step. Meanwhile, the number of blockchains will be significantly expanded, and we plan the following implementation by the end of the year:

- Fantom implementation.

- Avalanche implementation.

- Aurora implementation.

- Cronos implementation.

- Polygon implementation.

Short-Term Goals

- Improve the bridge decentralization.

- Improve the bridge automatization.

- Providing transactions at minimal cost with the highest security.

Mid/Long-Term Goals

- Research the possibility of bridge monetization to provide Bridge-as-a-Service features to multiple side projects.

- Introduce an abstracted bridge system that would allow for non-EVM blockchain bridge implementation.

- Masternodes implementation.

Callisto Masternodes – Towards a Fully Decentralized Bridge

In the current implementation, the cross-chain bridges are semi-centralized, and to decentralize and thus further secure our bridge model, we are developing a masternode-based cross-chain bridge.

The bridge’s operation will be based on a set of smart contracts running on layer 1 of the Callisto Network and a series of nodes called Masternodes, constituting a distributed computing infrastructure that composes layer 0 and provides processing, storage, and networking resources for the bridge operation.

With time, everyone will be able to participate in this network by creating a collateralized masternode and receiving rewards for providing the necessary resources for the bridge’s operation.

To create a masternode, a minimum collateral in the following 3 assets will be requested:

- Callisto Network coins (CLO).

- Callisto Enterprise tokens (CLOE).

- Soy Finance tokens (SOY).

To determine the eligible candidates, we will organize a queue; the position in the queue will be determined by the number of Callistonians Points (CP).

The Callistonians points will be calculated according to the amount of Callisto Network coins held in the participant’s wallet. Each day the participant holds Callisto Network coins, he will be awarded the same amount of CPs.

To determine the eligible candidates, we will organize a queue; the position in the queue will be determined by the number of Callistonians Points (CP).

The Callistonians points will be calculated according to the amount of Callisto Network coins held in the participant’s wallet. Each day the participant holds Callisto Network coins, he will be awarded the same amount of CPs.

Hack Investigation Department

Implementation: Q4-2022

Establishing a group of smart-contract security experts that will be responsible for investigating the hacks on the community request. The hack investigation department will be charged with identifying the exact feature of the smart contract that led to the hack, creating a hack investigation report, and making it publicly available.

If an audit report is available, the Hack investigation report must be compared to the security audit report of the hacked smart contract. A high level of transparency is ensured by the fact that both reports are publicly available and securely stored in a censorship-resistant data system.

Actions

- Publishing guidance on the cyber-security best practices.

- Perform hacking analysis and produce reports on a regular basis.

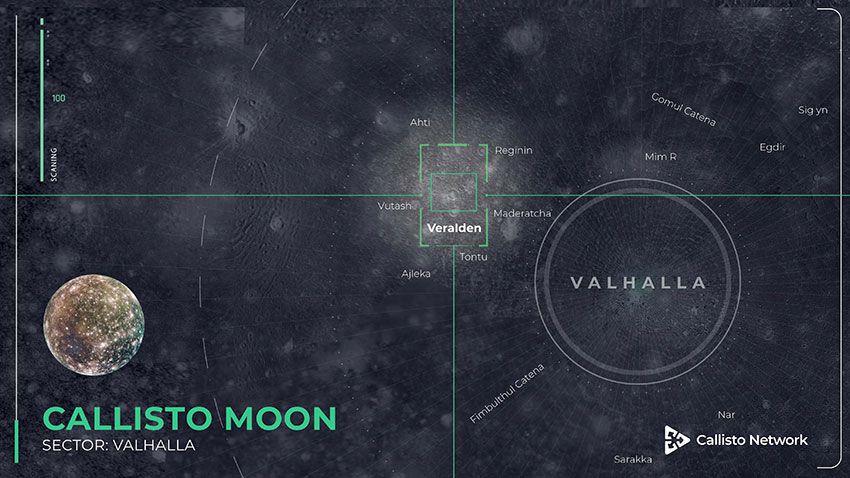

Veralden-radien Hard Fork - ZPoW

Implementation: Q1-2023

“Veralden-radien, literally the Ruler of the World, believed to support all growth and responsible for the continuity of life.”

Callisto Network relies on the Proof of Work (PoW) consensus mechanism, widely considered the most secure solution. Although PoW has its advantages, there are limitations as well: transaction throughput and confirmation latency. The performance of the Bitcoin PoW is security limited, meaning that it sacrifices the number of supported transactions per second to offer higher security.

By introducing the ZPoW, we want to address these limitations without sacrificing security. To do so, we are developing a solution that deconstructs the Nakamoto consensus mechanism into each basic and creates three types of blocks corresponding to the basic PoW operations:

- Voting blocks.

- Proposing blocks.

- Transaction blocks.

Instead of having one chain, several voting chains can be used with the voting blocks to point to the proposing blocks. Proposing blocks refer to the Transaction blocks, which point to a set of transactions that are not yet confirmed. Many transaction blocks can be present based on the transactions waiting to be confirmed.

The critical advantage of this solution is that leveraging the multiple chain width decreases the confirmation latency. Thus, instead of requiring a certain number of blocks to confirm a transaction, a minimum number of votes is needed to achieve the same or even better security (error probability) compared to bitcoin.

This way, a throughput of up to 100,000 transactions per second is expected, while the security level will be virtually identical to that of bitcoin.

Until the aforementioned solution is fully developed and to support the increasing number of transactions, we will increase the block size, increasing the capacity of the Callisto Network blockchain.

Note that the number of CLO coins in circulation will be capped at 3 billion in accordance with the dynamic monetary policy.

Short-Term Impacts

- Higher transaction throughput (higher tx/s).

- Lower latency (transaction confirmation delay).

- Better profitability for miners.

- Security level similar to that of the Bitcoin.

Mid/Long-Term Impacts

- Enable micro-transactions without compromising security.

- Further increasing the transaction throughput.

Distributed Insurance - Security For All

Implementation: Q1-2023

One of the main security engineering principles declares that “there is no system that can be engineered to be perfectly secure or absolutely trustworthy” (System Security Engineering TSAPPS at NIST).

Therefore, instead of trying to make a system ideally secure, it is better to focus on designing it so that it would be fault-tolerant. Adding more layers of protection improves the safety of the end-users much better than trying to improve the coding part.

While bug bounties and security audits are good, nothing can be done further after having performed them. Following the best security practices reduces the risk of being hacked significantly, but there is always a certain chance that things will go wrong.

Therefore there is no provable way to ensure that using a DApp is safe or not. Since the users are risking their funds by using DApps, the distributed insurance, by guaranteeing their funds, is beneficial for the entire DApp ecosystem.

Callisto Distributed Insurance Service – Security for all

The proposed solution is to develop an organization that will offer insurance services for the DApps development teams covering the funds that the DApp is expected to operate.

Providing distributed insurance is nothing different from regular insurance. The concept of insurance we are currently designing is based on two different agents:

– The insurance providers deposit insurance funds to insure a smart contract.

– The insurance customers pay a specific amount to obtain coverage of the funds deposited in a given smart contract.

It is worth mentioning that most insurance customers know the volume they operate with and have an allocated budget to improve the safety of their platform and thus the security of their user’s funds.

Therefore insurance customers can ensure the amount of funds they operate with and no longer need to worry about the security of their DApp. Instead, they can focus on their core activity and even leverage the safety of their platform through marketing at a minimal cost.

Eligibility

To be eligible for insuring a smart contract, the insurance customer must adhere to the following principles:

- The Callisto Network Security Department should have performed a security audit before applying for the insurance agreement. The contract must pass the security audit with all the high-threat issues fixed.

- Security Audit report must contain the information about the findings, possible threats, the owner privileges that can be used to manipulate the contract in theory, and the conclusion.

- The report must be stored in censorship-resistant and transparent data structures like IPFS.

- In case an update of the smart contract is performed, an audit should be performed. If the hack of an unaudited version leads to financial loss for smart contract developers or their customers, the loss will not be compensated by the insurance provider.

As long as the smart contract operates as intended, the insurance customers collect the amounts insurance fee to secure their funds. Shares of this income could be used to fuel the development and operative expenses of the Callisto Network Security Department.

By introducing this mechanism, the security of smart contracts is increased, and more people and entities are incentivized to check the safety of the smart contracts:

- The smart contract is safe:

- The Callisto Network Security Department acquires awareness.

- The Callisto Network community ear a profit.

- The smart contract is unsafe:

- The bug is found via a bug bounty, and the bounty hunter and the whole community benefit from the finding.

- The smart contract is hacked, and the “refunding budget” will be distributed to users who have suffered a loss.

Funding

Insuring a DApp presents a risk of fund loss for the insurance provider since it will have to pay the total amount of insured funds in case of a hack.

Therefore and with this in mind, Callisto Network and Soy Finance have created an insurance fund that has raised initial funding through the Soy Finance IDO. Later on, with the monthly payments being the primary funding source, the insurance provider is incentivized to increase the monthly payments for DApps representing the highest risk.